Fabulous Tips About How To Avoid Paying Social Security Tax

File a federal tax return as an individual and your combined income* is.

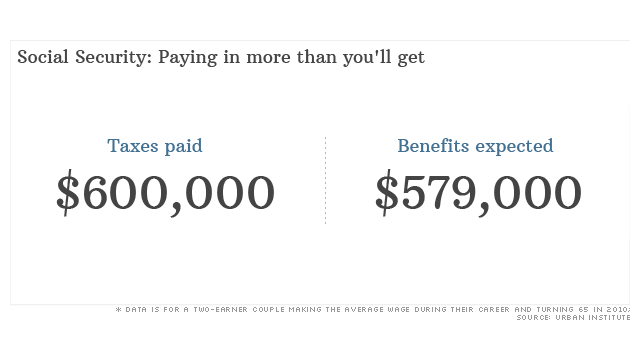

How to avoid paying social security tax. However, no one pays taxes on more than 85% percent of their social security. $6,200 in social security taxes paid by your business as an employer; Your retirement income may cause taxation of social security benefits and increase medicare part b premiums.

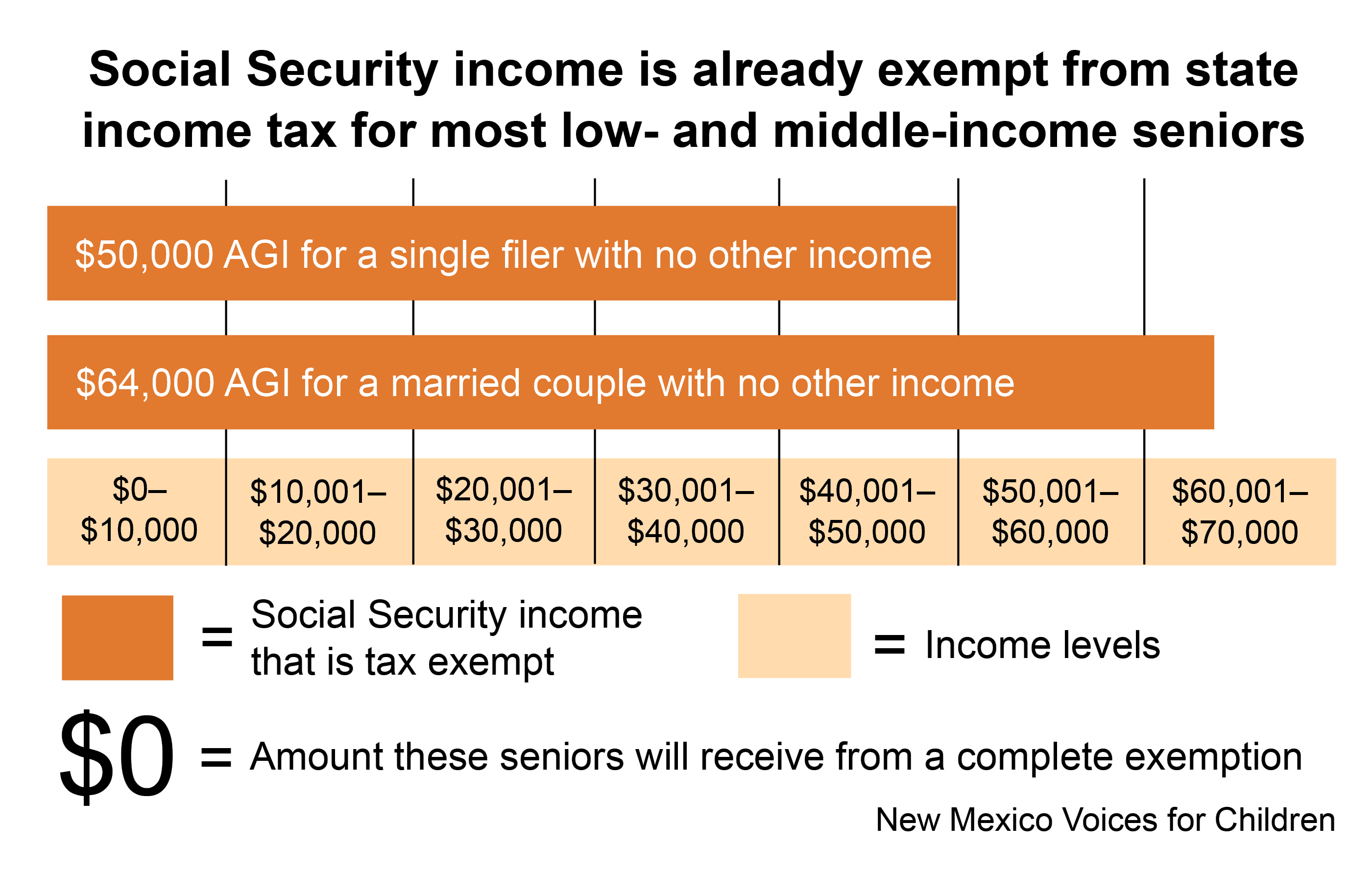

Social security benefits are included with other taxable income at the rate of 85%, 50%, or zero. Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. 3 ways to avoid taxes on benefits place some retirement income in roth accounts.

Here's how to reduce or avoid taxes on your social security benefit: Income tax on that salary is not difficult. Take these four steps to avoid these surprises in retirement.

$1,450 in medicare taxes you paid as an employee; So if you need to tap your retirement savings for your expenses, taking some money from a roth can minimize the income included in the social security tax calculation. $6,200 in social security taxes you paid as an employee;

One way is to claim the property as a second home, rather than an investment property. Manage your other retirement income sources. Beneficiaries can check their earnings history by using their my social security account, and if they notice any discrepancies, they should report them to social security.

The good news is that it is possible, but it might require a little finessing. Some people who get social security must pay federal income taxes on their benefits. Social security can be taxable, but there are strategies you can implement to make sure you never h.

How to avoid paying tax on your social security benefits! Manage your other retirement income sources. Stay below the taxable thresholds.

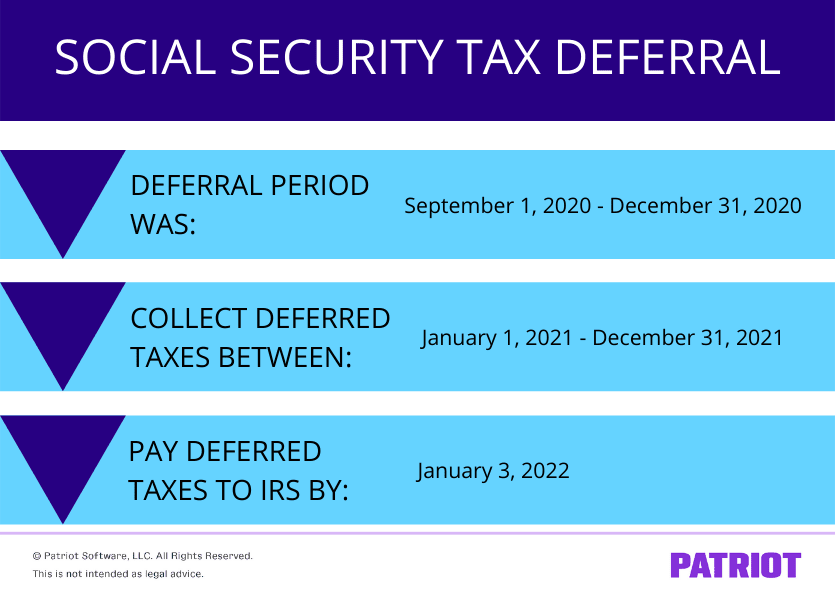

Both this year and next year, taxes will. If you depend on social security, those taxes can significantly lower your monthly deposits. There are a few ways to avoid paying taxes on rental income.

Withholding from your pay, your pension or certain government payments, such as social security. Stay below the taxable thresholds. Making quarterly estimated tax payments during the year.

Fortunately, there are ways to reduce your income and lower — or even avoid paying — taxes owed on your social security benefits. United states retirees will soon be paying more taxes on their social security. New social security payment to arrive in less than a week.

![Social Security Taxation [How To Avoid Paying Tax!] - Youtube](https://i.ytimg.com/vi/4scvBFeo09k/maxresdefault.jpg)

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

:max_bytes(150000):strip_icc()/GettyImages-485008004-0fc1bd9ac96844daa818ab6b90fff5bf.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)